Exness Leverage: Enhancing Trading Capacity

Home » Leverage

Leverage functions as a trading mechanism that allows market participants to control positions larger than their initial capital investment. At Exness, leverage serves as a tool for traders to access expanded market exposure while maintaining reasonable capital commitments.

Core Leverage Functions at Exness

Leverage multiplies trading capacity by allowing control of larger positions with smaller capital amounts. For example, with 1:1000 leverage, $1 of capital enables control of $1000 worth of trading instruments. This creates opportunities for generating returns on movements in larger position sizes than would otherwise be possible.

Instrument Type | Available Leverage Range |

Forex | 1:2 – 1:Unlimited |

Indices | 1:200 – 1:400 |

Metals | 1:20 – 1:100 |

Stocks | 1:20 – 1:Unlimited |

CFDs | 1:2 – 1:2000 |

Cryptocurrencies | Up to 1:400 |

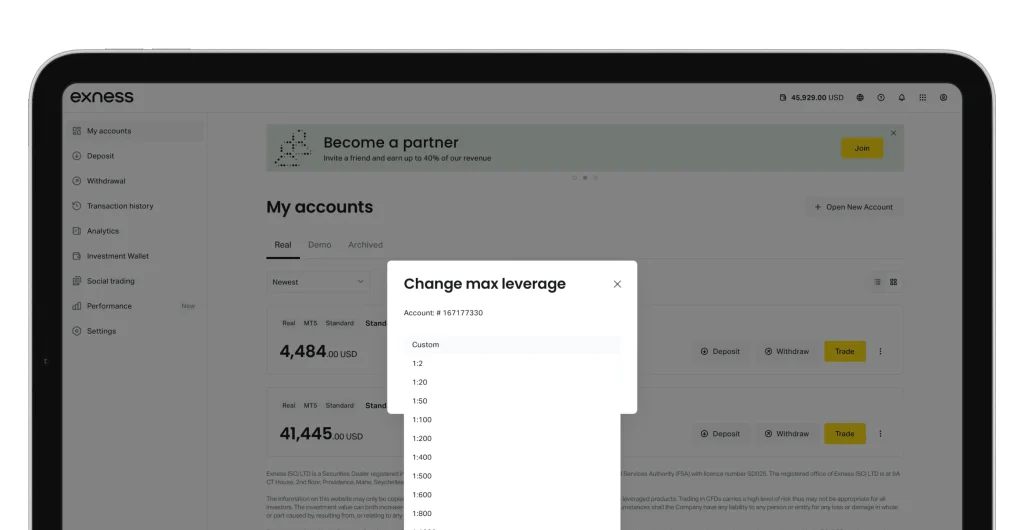

Leverage settings vary by account type, with standard accounts typically offering different options than professional accounts. The platform calculates margin requirements automatically based on selected leverage ratios.

Regional Leverage Frameworks

Geographic location significantly impacts available leverage options due to regulatory requirements in different jurisdictions.

European Union and United Kingdom Regulations

Traders under European Securities and Markets Authority (ESMA) and Financial Conduct Authority (FCA) regulation face standardized leverage restrictions:

- Major forex pairs: Maximum 1:30

- Non-major currency pairs: Maximum 1:20

- Major indices and gold: Maximum 1:20

- Other commodities: Maximum 1:10

- Individual stocks: Maximum 1:5

- Cryptocurrency instruments: Maximum 1:2

These limitations apply universally to all brokerages operating in EU member states and the UK.

International Leverage Standards

Outside restrictive regulatory frameworks, Exness offers more flexible leverage options. International accounts can access higher leverage ratios, potentially including the 1:Unlimited option under specific conditions.

For international accounts, maximum leverage varies by instrument: US indices at 1:400, other indices at 1:200, standard forex pairs up to 1:Unlimited, metals between 1:20 and 1:100, and share CFDs from 1:20 to 1:Unlimited.

Accessing Enhanced Leverage

To qualify for enhanced leverage options, particularly the 1:Unlimited setting, traders must:

- Complete at least 10 orders (excluding pending orders)

- Achieve minimum trading volume of 5 standard lots across all real accounts

- Maintain account equity below $1,000

For demo accounts, simply setting equity below $1,000 enables unlimited leverage automatically. When requirements are met, the system typically enables higher leverage options without further action.

Practical Leverage Application

When utilizing 1:1000 leverage, a $1,000 account can potentially control positions valued at $1,000,000. A 1% price movement could generate $10,000 in profit or loss – far more than the original capital amount.

The margin system provides safety mechanisms when using leverage. Each position requires a specific margin allocation based on the selected leverage ratio. If account equity approaches minimum margin requirements, the system issues margin call notifications. If equity falls below maintenance thresholds, positions face automatic closure.

For practical leverage management, calculate position sizes based on acceptable risk percentages and implement stop-loss orders to define maximum loss thresholds. Monitoring margin levels consistently during active trading periods is essential.

Risk Considerations with Leverage

Leverage magnifies both profit potential and loss risk proportionally. Experienced traders typically limit risk exposure to 1-3% of account equity per individual trade, regardless of leverage settings.

Higher leverage works effectively for traders with established strategies rather than those still developing consistent approaches. The unlimited leverage option requires particularly disciplined risk management practices.

Understanding 1:Unlimited Leverage

The 1:Unlimited leverage option represents the highest tier in Exness leverage offerings. This setting enables extremely small margin requirements for opening positions, allowing substantial market exposure with minimal capital allocation.

Many traders find balanced leverage options (like 1:500 or 1:1000) provide sufficient position sizing capability while maintaining more manageable risk profiles. The platform automatically adjusts available leverage during major market events and news releases to protect client accounts from extreme price movements.

Leverage During Volatile Market Conditions

Exness may temporarily reduce maximum available leverage during major economic announcements, unexpected market events, or weekend market transitions. The system notifies traders about temporary leverage changes through platform announcements.

Experienced traders often voluntarily reduce leverage during unpredictable market conditions regardless of platform limitations. This precautionary approach reduces exposure during periods when price action may become erratic.

FAQ: Preguntas Frecuentes

What is the highest leverage available at Exness?

The 1:Unlimited leverage represents the maximum option at Exness. This setting becomes available after meeting specific criteria: completing at least 10 orders, achieving 5 standard lots trading volume, and maintaining account equity below $1,000. Regional regulations may restrict maximum leverage regardless of these qualifications, particularly in EU countries and the UK.

How does leverage affect margin requirements?

Leverage inversely impacts margin requirements. Higher leverage reduces necessary margin for opening positions. For example, with 1:100 leverage, a $10,000 position requires $100 margin allocation (1% of position value). When using 1:1000 leverage, the same position requires only $10 margin (0.1% of position value). The platform automatically calculates margin requirements based on current leverage settings.

Will Exness change my leverage settings during trading?

Exness may temporarily adjust leverage during periods of high market volatility, major economic announcements, or weekend market transitions. These adjustments help protect trader accounts from extreme price movements. The system provides notifications when such changes occur. Traders can also manually modify their leverage settings through the personal area.

Is unlimited leverage suitable for new traders?

Unlimited leverage requires substantial risk management experience. New traders benefit from starting with more conservative leverage settings (1:50 or lower) while developing consistent strategy performance. The extreme position sizing capability of unlimited leverage creates heightened sensitivity to price movements, potentially accelerating account depletion without proper risk protocols.