Exness Withdrawal: Complete Guide

Home » Withdrawal

This comprehensive guide presents all necessary information about the withdrawal process on Exness. It covers available methods, processing times, verification requirements, and troubleshooting steps for clients.

Overview of Withdrawal Process

The Exness withdrawal system provides multiple options for fund retrieval. Clients can withdraw profits and deposited funds through various payment methods depending on their account region and verification status. The process follows strict security protocols to ensure safe transfer of funds.

Withdrawal requests undergo verification checks before processing. The system prioritizes prompt handling while maintaining compliance with financial regulations. Clients must complete verification procedures before withdrawing funds from their trading accounts.

Aspect | Details |

Methods | Electronic payment systems, bank cards, bank transfers, cryptocurrencies |

Processing Times | From instant to 5 business days depending on method |

Currencies | Multiple currencies supported based on account denomination |

Minimum Amount | Varies by payment method and region |

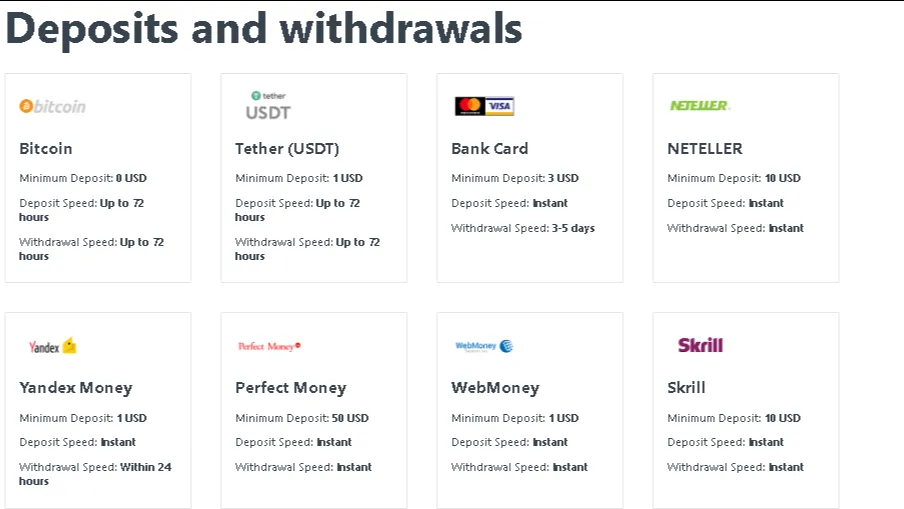

Available Withdrawal Methods

Exness supports various withdrawal channels to accommodate different client preferences and regional availability. Payment methods include electronic payment systems, bank transfers, payment cards, and cryptocurrencies.

Electronic Payment Systems

Electronic payment systems provide fast withdrawal options. Skrill and Neteller process transactions with minimal delay. Perfect Money enables transfers to digital accounts. WebMoney facilitates withdrawals in multiple currencies. Local electronic payment options vary by region with country-specific systems available in many locations.

Bank Cards

Visa and Mastercard withdrawals process through the original cards used for deposits. Card withdrawals typically require 1-3 business days for completion after approval. Some regions have additional supported card networks based on local availability.

Bank Transfers

Direct bank transfers enable withdrawals to personal bank accounts. International transfers use SWIFT/IBAN systems with standard banking protocols. Local bank transfers provide domestic options in specific countries. Processing times for bank transfers range from 1-5 business days depending on destination bank and region.

Cryptocurrency Withdrawals

Bitcoin withdrawals process through blockchain networks. Ethereum transactions follow standard crypto transfer protocols. Tether (USDT) provides stablecoin withdrawal options. Additional cryptocurrencies may be available based on regional restrictions and current offerings.

Withdrawal Limits and Conditions

Withdrawal limits vary according to account type, verification status, and payment method. Minimum withdrawal amounts depend on the chosen payment system. Maximum limits adjust based on account verification level and trading activity.

Standard accounts have specified weekly and monthly withdrawal limits. Professional accounts receive adjusted limit structures based on trading volume. Verified accounts access higher withdrawal limits than unverified ones.

Withdrawal fees vary by payment method with some options offering zero-fee transfers. Third-party processors may apply additional charges outside Exness control. Fee structures appear during the withdrawal request process for client review before confirmation.

Withdrawal Processing Timeline

Processing times depend on the selected payment method and verification status. Requests undergo security checks before approval with typical processing as follows:

Internal system processing requires up to 24 hours for initial verification. Electronic payment systems typically complete within 24 hours after approval. Bank card withdrawals generally require 1-3 business days after processing. Bank transfers may take 1-5 business days depending on recipient bank.

Weekend and holiday periods may extend processing times due to limited banking operations. Status updates appear in the client’s personal area throughout the process.

Account Verification Requirements

Verification status directly affects withdrawal capabilities. All accounts require basic verification before withdrawals. The verification process includes identity confirmation and address validation steps.

Identity verification requires government-issued identification documents. Address verification needs utility bills or bank statements dated within three months. Additional verification may apply depending on account activity and withdrawal amounts.

Verified accounts experience faster processing and higher withdrawal limits. Verification status indicators appear in the personal area dashboard. Support staff can provide guidance on specific verification requirements.

Withdrawal Request Procedure

The withdrawal process follows a standardized procedure through the client’s personal area. Clients must ensure sufficient available funds before initiating requests.

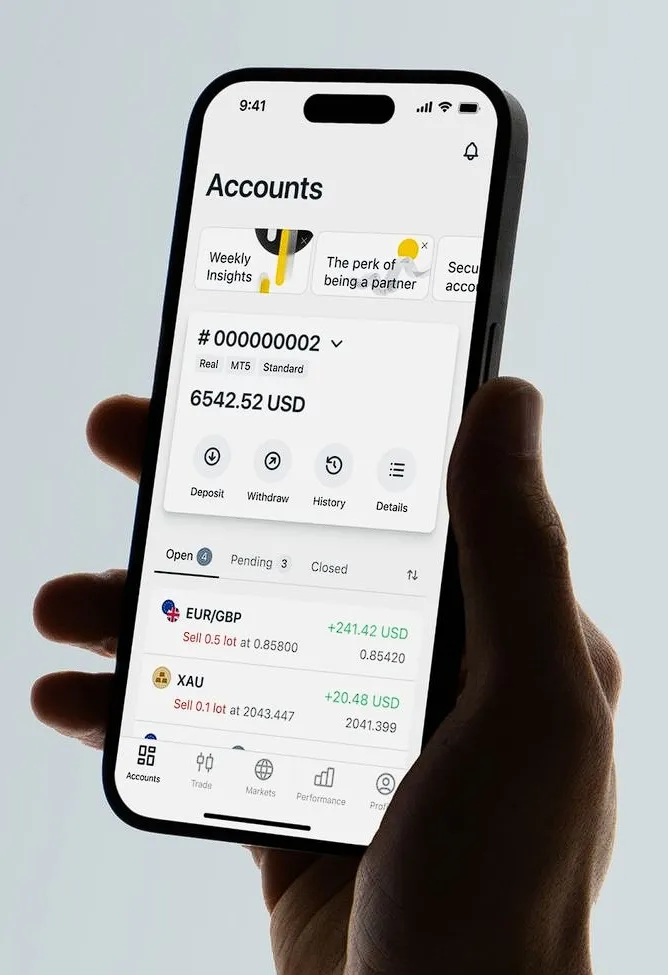

First, access your Exness personal area through the website or mobile application. Navigate to the “Withdraw Funds” section in the financial operations area. Select your preferred withdrawal method from available options. Enter the withdrawal amount within applicable limits. Review and confirm withdrawal details including any applicable fees. Submit the request and note the provided transaction reference number.

The system will process the request according to standard timelines. Status updates appear in the transaction history section. Email notifications confirm key stages of the withdrawal process.

Common Withdrawal Issues and Solutions

Certain issues may affect withdrawal processing. Understanding common problems helps resolve them efficiently.

Insufficient verification often causes withdrawal delays. Complete all verification steps through the personal area to resolve this issue. Payment method discrepancies occur when withdrawal and deposit methods don’t match as required. Use consistent payment methods or contact support for alternatives.

Regional restrictions may limit certain payment methods in specific locations. Check available options for your region in the withdrawal section. Contact support for guidance on region-specific alternatives.

Security Measures for Withdrawals

Multiple security protocols protect the withdrawal process. The system implements measures to prevent unauthorized access while maintaining efficient processing.

Two-factor authentication provides additional security for withdrawal requests. IP verification checks ensure requests come from recognized devices. Withdrawal confirmation emails require verification before processing continues. Security questions may apply for large or unusual transactions.

Withdrawal to Different Payment Methods

Withdrawals generally process to the same method used for deposits. This policy complies with anti-money laundering regulations and security protocols.

If the original deposit method becomes unavailable, alternative options exist. Contact customer support to discuss available alternatives. Documentation requirements increase when changing withdrawal methods.

Regional Considerations for Withdrawals

Available methods and processing times vary by region due to local regulations and payment system availability. The personal area displays only methods available in your location.

European clients access SEPA transfers with standardized processing. Asian regions have specialized local payment options. Middle Eastern countries follow specific compliance requirements. African regions utilize region-specific mobile payment systems where available.

Mobile App Withdrawals

The Exness mobile application provides complete withdrawal functionality. All methods available on the website also function through the mobile platform. The interface adapts to mobile screens while maintaining security protocols.

Mobile withdrawals follow identical processing timelines as website requests. Security features include biometric authentication options on supported devices. Push notifications provide status updates throughout the withdrawal process.

Support Services for Withdrawal Issues

Dedicated support channels assist with withdrawal questions and concerns. Support staff access account details to provide specific guidance.

Live chat representatives offer immediate assistance with withdrawal inquiries. Email support provides documented responses to withdrawal questions. Regional phone support offers guidance in multiple languages.

The help center contains detailed withdrawal instructions with visual guides. Support staff can escalate complex withdrawal issues to financial departments when necessary.

FAQ: Preguntas Frecuentes

How long do withdrawals take to process?

Processing times vary by payment method. Electronic payment systems typically complete within 24 hours after approval. Bank card withdrawals require 1-3 business days. Bank transfers take 1-5 business days depending on the receiving bank. Cryptocurrency withdrawals generally process within 24 hours after confirmation. All timelines begin after successful verification of the withdrawal request.

Why was my withdrawal request rejected?

Withdrawal rejections typically occur for several specific reasons. Incomplete verification prevents processing—ensure all verification documents are approved in your personal area. Insufficient funds occur when withdrawal amounts exceed available balance after accounting for open positions and margin requirements. Payment method mismatches happen when attempting to withdraw to a method different from the deposit source without prior arrangement. Contact support for detailed information about specific rejection reasons.

Can I withdraw to a different payment method than I used for deposit?

Generally, funds must be withdrawn to the same payment method used for deposits to comply with anti-money laundering regulations. If the original payment method is unavailable, contact support to discuss alternatives. Additional documentation and verification will be required for any exception to this policy. Once deposits are fully withdrawn through the original method, remaining profits can potentially be withdrawn through alternative available methods.

What are the verification requirements for withdrawals?

All withdrawals require account verification. Basic verification includes identity confirmation through government-issued ID and address verification using utility bills or bank statements less than three months old. Large withdrawals may trigger enhanced verification requirements. First-time withdrawals often undergo additional security checks. Verification status is visible in your personal area, and incomplete verification will limit or prevent withdrawals until resolved.

Conclusion

The Exness withdrawal system provides multiple options for accessing funds from trading accounts. By following standard procedures and verification requirements, clients can efficiently retrieve profits and deposits. The system balances security measures with processing efficiency to maintain fund safety while providing timely access.

For specific questions about withdrawal methods and procedures, contact Exness support through available channels. Representatives remain available to assist with individual withdrawal requirements and provide guidance for optimal processing.